The Buzz on Guided Wealth Management

The Buzz on Guided Wealth Management

Blog Article

Top Guidelines Of Guided Wealth Management

Table of ContentsThe Best Strategy To Use For Guided Wealth Management6 Simple Techniques For Guided Wealth ManagementThe Single Strategy To Use For Guided Wealth ManagementFacts About Guided Wealth Management UncoveredThe Facts About Guided Wealth Management Uncovered

Here are 4 points to think about and ask yourself when determining whether you should tap the expertise of a financial advisor. Your web worth is not your income, however rather an amount that can aid you understand what money you make, just how much you conserve, and where you spend money, too., while obligations consist of credit score card bills and mortgage repayments. Of training course, a positive net well worth is far much better than a negative net worth. Looking for some direction as you're assessing your monetary situation?

It's worth keeping in mind that you don't require to be wealthy to seek guidance from a financial consultant. A significant life adjustment or choice will set off the decision to browse for and hire an economic expert.

Your child is on the means. Your divorce is pending. You're nearing retired life (https://www.dreamstime.com/bradcumner4020_info). These and various other significant life events may prompt the demand to check out with an economic advisor concerning your investments, your financial objectives, and other monetary matters. Let's claim your mother left you a neat sum of money in her will.

Get This Report about Guided Wealth Management

In general, a monetary advisor holds a bachelor's level in an area like finance, bookkeeping or organization monitoring. It's likewise worth absolutely nothing that you could see a consultant on a single basis, or work with them extra consistently.

Any individual can say they're a monetary expert, yet an expert with expert designations is ideally the one you must employ. In 2021, an approximated 330,300 Americans functioned as personal monetary experts, according to the U.S. Bureau of Labor Data (BLS).

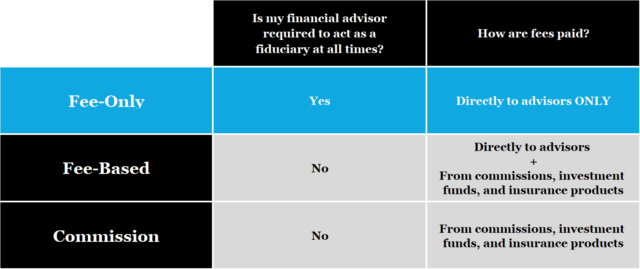

Unlike a registered rep, is a fiduciary who should act in a customer's best rate of interest. Depending on the value of possessions being taken care of by a signed up investment consultant, either the SEC or a state safety and securities regulator manages them.

Examine This Report about Guided Wealth Management

As a whole, though, monetary planning professionals aren't looked after by a solitary regulator. An accountant can be considered an economic organizer; they're managed by the state accounting board where they practice.

Offerings can consist of retired life, estate and tax obligation preparation, in addition to financial investment management. Wide range supervisors usually are signed up agents, suggesting they're regulated by the SEC, FINRA and state protections regulators. A robo-advisor (financial advisor redcliffe) is a computerized online financial investment manager that counts on algorithms to deal with a client's properties. Customers generally don't gain any kind of human-supplied monetary suggestions from a robo-advisor service.

They make money by charging a cost for every trade, a level monthly charge or a portion fee based on the dollar amount of assets being taken care of. Investors trying to find the best advisor needs to ask a number of questions, consisting of: An economic advisor that deals with you will likely not coincide as an economic advisor who deals with an additional.

Guided Wealth Management Things To Know Before You Get This

Some consultants might profit from marketing unneeded items, while a fiduciary is legitimately called for to select investments with the client's needs in mind. Making a decision whether you need a financial advisor entails evaluating your economic situation, determining which kind of economic advisor you need and diving into the history of any type of monetary consultant you're assuming of employing.

To accomplish my company your goals, you might require a proficient specialist with the appropriate licenses to assist make these plans a fact; this is where an economic advisor comes in. Together, you and your advisor will certainly cover lots of topics, consisting of the amount of cash you must save, the types of accounts you require, the kinds of insurance coverage you should have (including long-term care, term life, handicap, etc), and estate and tax planning.

Guided Wealth Management for Dummies

At this factor, you'll likewise allow your advisor know your investment preferences. The initial assessment might additionally consist of an assessment of various other financial management topics, such as insurance problems and your tax situation.

Report this page